pay indiana tax warrant online

Take the renters deduction. You should also know the amount due.

Welcome To The Dubois County Sheriff S Office

Claim a gambling loss on my Indiana return.

. Mail - Payable to. Once you enter the search criteria all Pay Location Codes that match the search will load. Send in a payment by the due date with a check or money order.

Or you can search by. On-line payment companies charge processing fees for their services. Tax Warrant Payment Methods.

Also called a lien the warrant is a public record that allows the government to claim your personal property or assets to satisfy the unpaid taxesIf you have unpaid taxes and have received notification of a tax warrant heres what you need to. Hamilton County Sheriffs Office 18100 Cumberland Road. 295 or 195 minimum If you do not wish to pay the above-stated fees DO NOT utilize one of these payment options.

Make a payment online. Developed by WTH this innovative technology provides revolutionary capabilities including pin-point mapping synchronized data sharing and instant software updates together with industry-leading customer support. The following fees apply.

We now have tax warrant data for the entire state of Indiana and this information can be searched from the Welcome Page or by clicking on the tax warrants tab. Find Indiana tax forms. Pay my tax bill in installments.

INtax - Log In or Create new Account INtax will continue to provide the ability to file and pay for the following tax types until July 2022. If you have questions concerning your taxes or disagree with the amount owed contact the Indiana Department of Revenue at 317-232-2165. When you use one of these options include your county and warrant number.

Enter PLC Pay Location Code is 7765 to be directed to Porter County-Civil Bureau-Tax Warrants. Tax warrant payments can be mailed money order or cashiers check to the Sheriffs Office or paid online using the following website. Click on the Pay Location Code you want and it will load in the box.

All groups and messages. Know when I will receive my tax refund. It looks like something has gone wrong.

You can set up a payment plan with the Indiana Department of Revenue by calling 317-232-2240 or visiting httpsintimedoringoveServices. The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME to offer the ability to manage tax account s in one convenient location 247. A tax warrant is a notification to the county clerks office that a taxpayer owes a tax debt and that the debt will be referred to the county sheriff or a professional collection agency to collect the money owed.

Use the CC Code and Warrant located in the upper right part of this letter as your. Tax Liabilities and Case Payments. Doxpop provides access to over current and historical tax warrants in Indiana counties.

A tax warrant is a legal action that can be brought against you by the state or federal government if you fail to pay your taxes. Our service is available 24 hours a day 7 days a week from any location. Do not call the Hendricks County Sheriffs Office as this agency has nothing to do with setting the amount of taxes owed.

To get started click on the appropriate link. These should not be confused with county tax sales or a. Plan B is if you received a tax warrant by your countys sheriffs department for failure to pay your state taxes you must contact them immediately to avoid a court appearance.

Or we can help you. After you have read your letter and wish to set up a payment plan you may call the Hendricks County Sheriffs. INTAX only remains available to file and pay special tax obligations until July 8 2022.

If you are disputing the amount owed call the Department of Revenue at. Special Fuel - SFT. Motor Fuel - MFT.

The Indiana Department of Revenue DOR is in the process of moving to its new online e-services portal INTIME which will soon offer all customers the ability to manage tax account s in one convenient location 247. 1 First The Indiana Department of Revenue itself attempts to collect your Indiana back tax debt by sending you demands via US Mail. Pay online using MasterCard Visa or Discover at the Indiana state government ePay website see Resources.

When prompted provide your taxpayer identification number or Social Security number and your liability number or warrant number. You can set up a payment plan with the Indiana Department of Revenue by calling 317-232-2165 or visiting wwwintaxpayingov. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident.

Contact the Indiana Department of Revenue DOR for further explanation if you do not understand the bill. When you receive a tax bill you have several options. Depending on the amount of tax you owe you might have up to 36 months to pay off your tax debt.

Think GIS is one of the worlds most accessible GIS software solutions. Gasoline Use Tax - GUT. To pay on-line please click the secure MAKE A PAYMENT link below.

Create an INtax Account. Have more time to file my taxes and I think I will owe the Department. If you know the Pay Location Code enter it in the box below.

Pay Location Code Name City State or Zip Code. Our information is updated as often as every ten minutes and is accessible 24 hours a day 7 days a week. This includes making payments setting up payment plans viewing refund amounts and secure messaging with DOR customer service.

But dont worry were working to get it back on track. To file andor pay business sales and withholding taxes please visit INTIMEdoringov. Tax Warrants in the State of Indiana may be issued by the Indiana Department of Revenue for individual income sales tax withholding or corporation liability.

Indiana State Tax Information Support

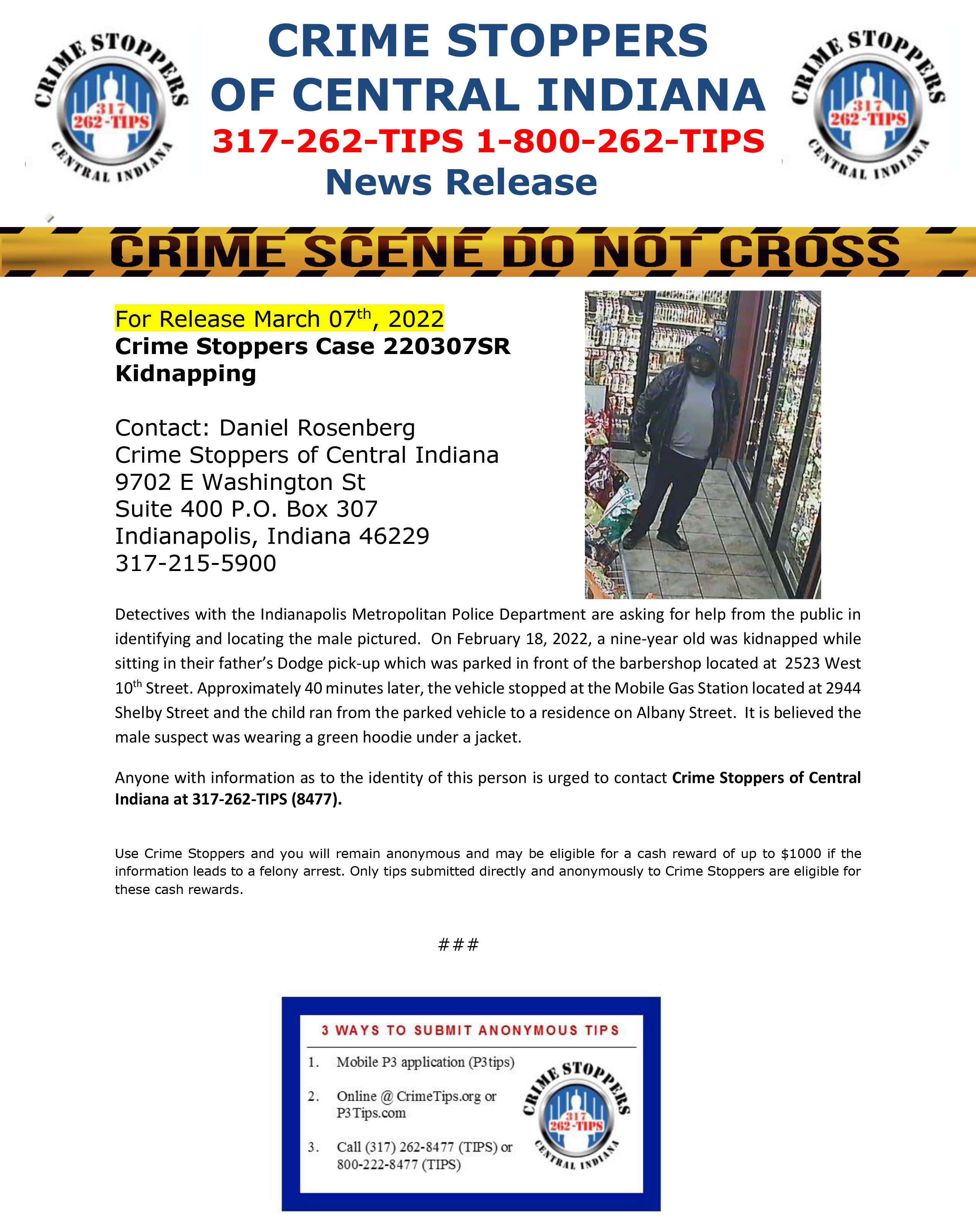

Warning Tax Warrant Scam Circulating In Marion County Wyrz Org

Indiana Dept Of Revenue Inrevenue Twitter

State Form 23037 Download Fillable Pdf Or Fill Online Affidavit Of Ownership For A Vehicle Indiana Templateroller

Sample Letter To Judge To Remove Warrant Fill Online Printable Fillable Blank Pdffiller

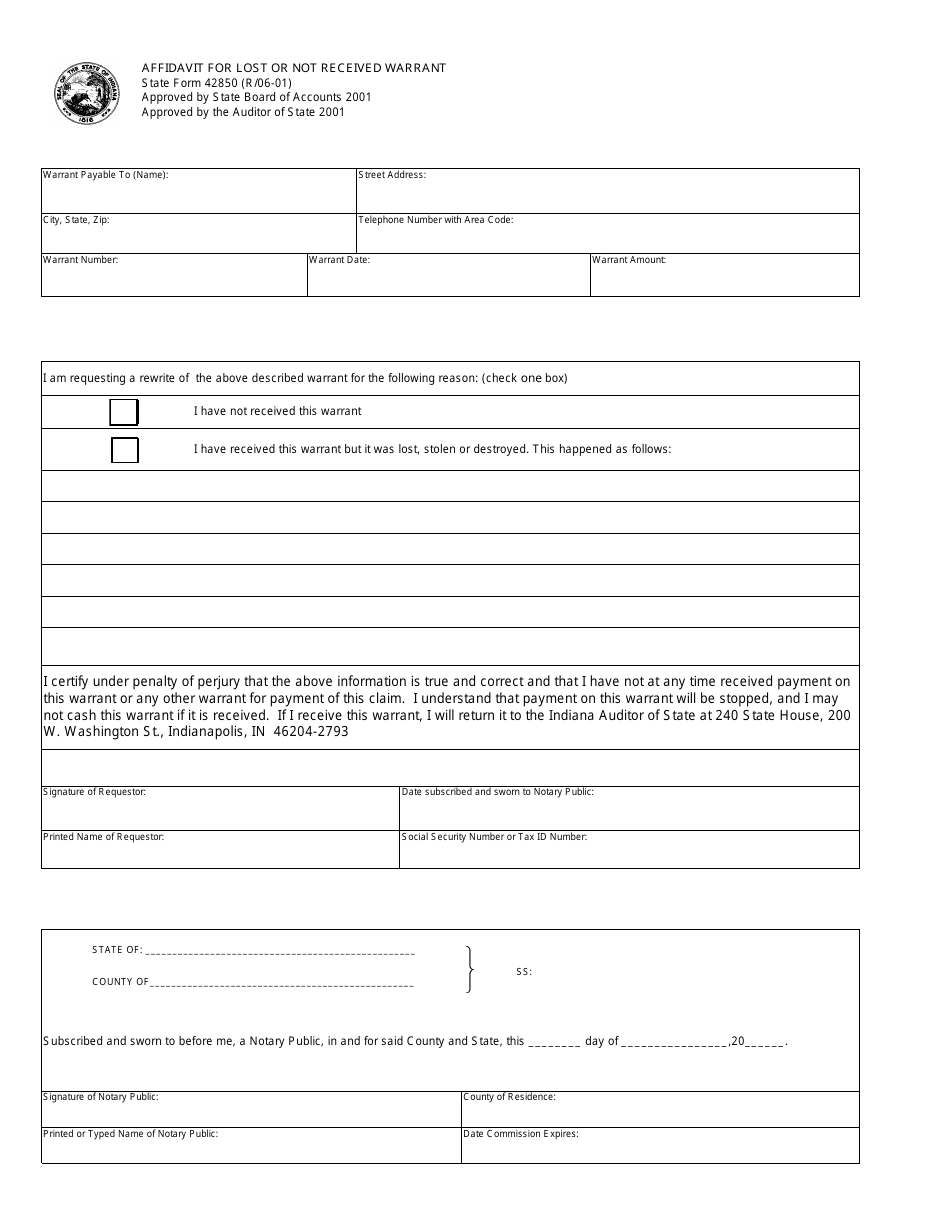

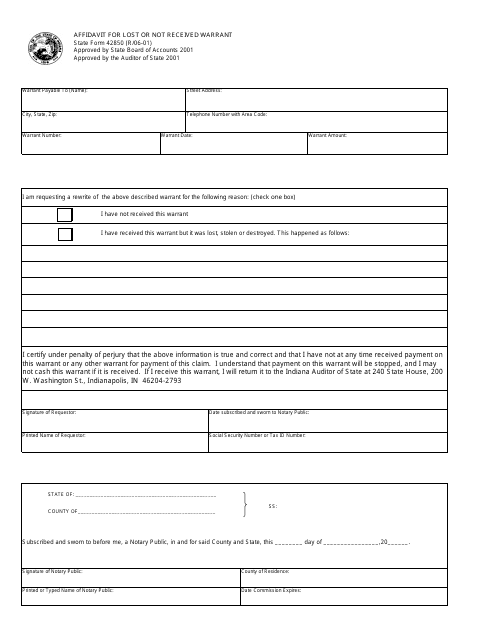

State Form 42850 Download Fillable Pdf Or Fill Online Affidavit For Lost Or Not Received Warrant Indiana Templateroller

Payment Plan Agreement Template Word New 8 Installment Payment Contract Template Lesson Plan Template Free Letter Template Word How To Plan

Dor Indiana Extends The Individual Filing And Payment Deadline

State Form 42850 Download Fillable Pdf Or Fill Online Affidavit For Lost Or Not Received Warrant Indiana Templateroller

Idoc Indiana Department Of Correction Fugitives

Search Warrant Basics In Indiana Blankenship Law Llc

Dor Act Quickly To Avoid Late Fees Or Penalties

Dor Your State Tax Dollars At Work

Indiana Warranty Deed Fill Online Printable Fillable Blank Pdffiller

Sample Letter To Judge To Remove Warrant Fill Online Printable Fillable Blank Pdffiller