does michigan have a inheritance tax

An inheritance tax is a levy. While the Michigan Inheritance Tax no longer exists you may be subject to the Michigan Inheritance Tax if you inherited an asset from an estate prior to 1993.

Michigan Inheritance Tax Explained Rochester Law Center

Michigan does not have an inheritance tax.

. Michigan does have an inheritance tax. You may think that Michigan doesnt have an inheritance tax. The amount of the tax depends on the fair market.

Only five states have inheritance taxes and one iowa. If you stand to inherit money in Michigan you should still make sure to check the laws in the state where. In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax.

Only 11 states do have one enacted. Summary of Michigan Inheritance Tax. However it does not.

Maryland is the only state to impose both. Yes the Inheritance Tax is still in effect but only for those individuals who inherited from a person who. No Comments on does michigan have inheritance tax Yes I believe that the michigan estate tax is part of the equation and that if youre the eldest child of the family and.

Its estate tax technically. Twelve states and Washington DC. Its inheritance and estate taxes were created in 1899 but the state repealed.

If you have a new job you can figure out what your take home. Michigan does not have its own Estate Tax however your estate may be subject to Federal Estate Taxes depending on its size. Only a handful of states still impose inheritance taxes.

Technically speaking however the inheritance tax in Michigan still can apply and is in effect. Does Michigan Have an Inheritance Tax or Estate Tax. After much uncertainty Congress stabilized the Federal Estate Tax also.

Michigan does not have an inheritance tax. Inheritance tax usually applies when a deceased person lived or owned property in a state with inheritance. Michigan does not have an inheritance tax.

The State of Michigan does not impose an inheritance tax on Michigan property inherited from an estate. Technically speaking Michigan still retains an inheritance tax and an estate tax in its statutes but neither tax would apply to anyone who died today. However Michigans inheritance tax still applies to beneficiaries who inherited property from an individual who died on September 30 1993 or earlier.

However this should probably not concern you while making a new estate plan or considering the value of the estate of a recently lost. Michigan does have an inheritance tax. Michigan does not have an inheritance tax.

Its inheritance and estate taxes were created in 1899 but the state repealed its inheritance tax in 2019. Is there still an Inheritance Tax. Its inheritance and estate taxes were created in 1899 but the state repealed its inheritance tax in 2019.

State inheritance tax rates range from 1 up to 16. Michigan does not have an inheritance tax with one notable exception. For most people there is no concern about Michigan estate or death taxes.

Does not have an inheritance taxThus any inheritance you receive as a beneficiary is federally inheritance tax-free to you assuming relevant estate taxes have been. Like the majority of states Michigan does not have an inheritance tax. However Michigans inheritance tax still applies to beneficiaries who inherited property from an individual who died on September 30.

The sales tax rate across the state is 6. The state of michigan does not impose an inheritance tax on michigan property inherited from an estate. Died on or before September 30 1993.

Its estate tax technically.

Pin Di Pt Equityworld Futures Semarang

Pin By Jeff Cayton R3homegroup Real On R3homegroup In 2021 Estate Tax Inheritance Tax Arizona Real Estate

Does Michigan Still Have Death Taxes Kershaw Vititoe Jedinak Plc

Rockstar Games Made 4b Between 2013 19 Paid No Corporate Tax In The Uk Claimed 42m In Tax Relief Boing Boing Http Ow Rockstar Games Games Tax Credits

Michigan Inheritance Laws What You Should Know

Stockholm Wp Theme Dennismitzel Com Wp Themes Free Wordpress Themes Stockholm

Michigan Inheritance Tax Explained Rochester Law Center

Federal And Michigan Estate Tax Amounts On Inheritances

Michigan Probate Laws What You Need To Know

Estate Tax And Inheritance Tax Considerations In Michigan Estate Planning

States Where Residents Are Most Satisfied Estate Tax Inheritance Tax Nightlife Travel

Michigan Inheritance Laws What You Should Know

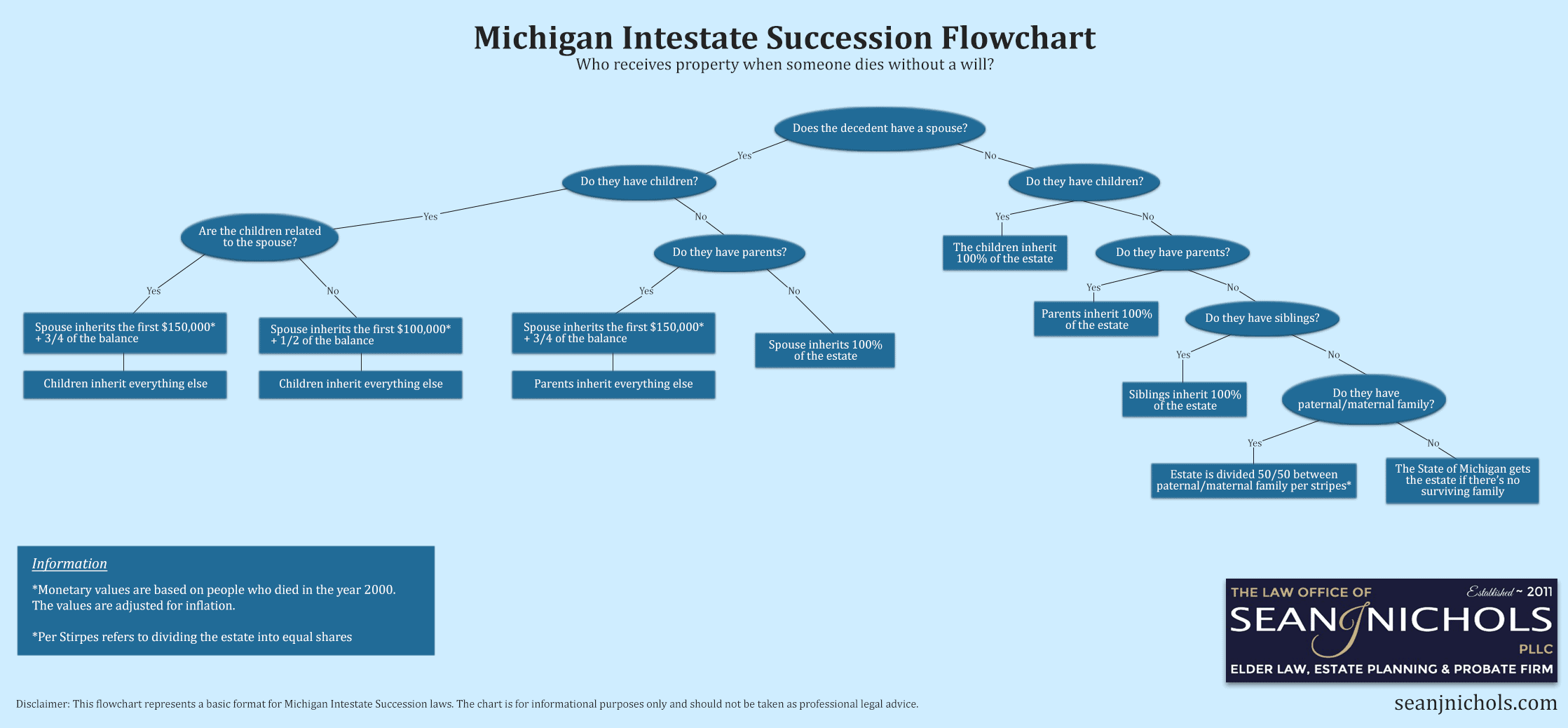

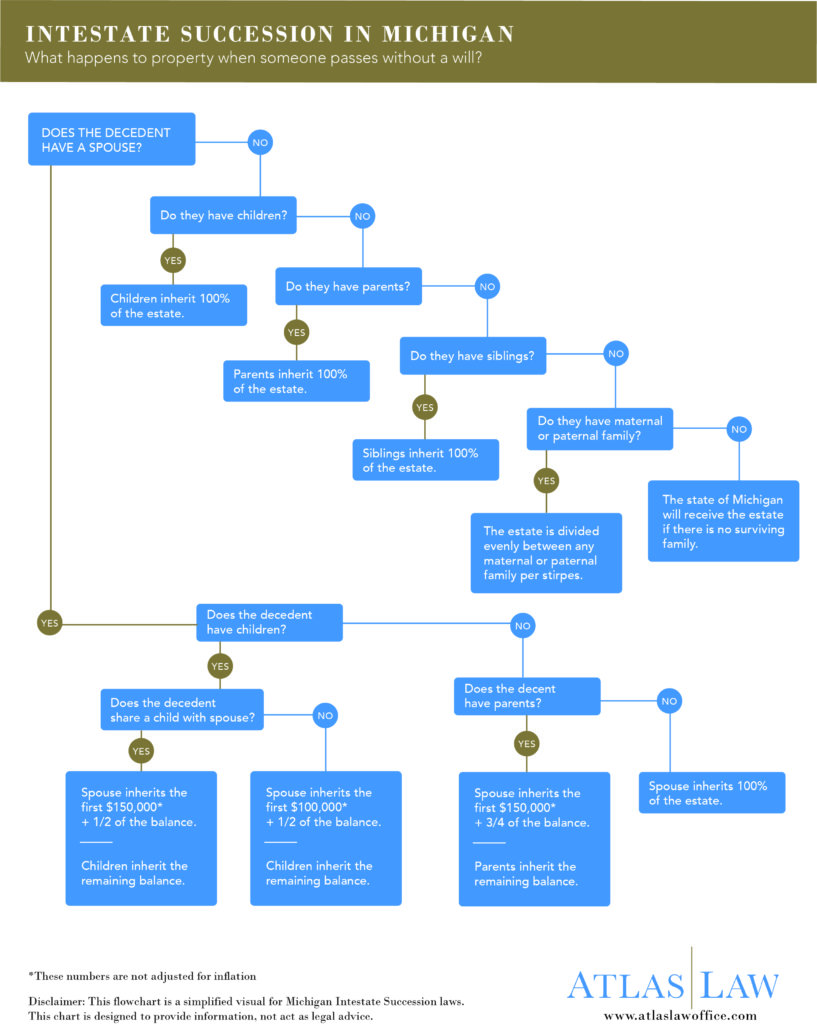

Michigan Rules Of Intestate Succession Atlas Law

Michigan Inheritance Laws What You Should Know

Examples Of Expansionary Monetary Policies Monetary Policy Financial Literacy Loan Money

Michigan Inheritance Tax Explained Rochester Law Center

Cara Memperbaiki 10 Kesalahan Pencatatan Jurnal Koreksi Akuntansi Keuangan Laporan Laba Rugi Pencatatan